I started my professional career in 1996 in corporate insolvency law and insolvency administration. From the start on, though, I was rather interested in saving companies than merely liquidating them. In the following years I therefore specialised in the operative and financial restructuring of companies in addition to my legal skills. Since 2013 I am certified as a Certified Turnaround Professional (EACTP) and since 2014 I am a partner with management consulting firm CIC Consultingpartner GmbH.

During my professional career I further developed an expertise in forensic services, since crimes were the original trigger to the crisis of several of the turnaround cases I dealt with.

The basis for the aforementioned focus lies in my sound education and experience in general business law, in particular in commercial and corporate law.

Already due to the time pressure, my involvement ususually does not stop with the presentation of a theoretical solution, rather I focus on the execution of the mutually agreed strategy. Therefore, I am not limited to mere counseling, but I also take operational responsibility, e.g. as a managing director. Often, companies also use my competence to prepare for crisis scenarios or for preventing a crisis altogether.

From the beginning, I advised clients in an international context, be it German companies regarding legal issues abroad, be it foreign companies in Germany. The focus of my international activity lies in the USA, England, France, Switzerland and Austria. Based on my international work over the years and active membership in several (international) organizations, for example in the respective chapters of the Turnaround Management Association in Germany and the UK, I can draw on a widespread international network.

operational roles

Seldomly, the mere answering of legal questions or drawing-up of concepts actually solve problems. Rather, the agreed solutions must be implemented in a practical manner. That is why, in appropriate cases, I also assume operational responsibility for the implementation of concepts, whether as managing director, board of directors or supervisory board (advisory board), trustee, self-administrator or liquidator in the case of disinvestments.

References ▾

- Board of directors of a cooperative, stabilisation after separation of two board members as a result of extensive criminal investigations, creation of transparency for supervisory board and successor board members, processing of past-related facts.

- managing director of a limited liability company in the social economy, avoiding insolvency, preparing a reorganisation report and implementing reorganisation measures, raising further financing, developing sales, marketing, business organisation and controlling

- Member of the advisory board of a medium-sized Berlin group of companies, including restructuring of company processes, implementation of a reporting structure, development of the supervisory body, advising the shareholder on strategic issues, debt relief for the group of companies

- Managing director of a law firm, establishing a German office and co-establishing an international office of the law firm, development of sales and marketing, business organisation and controlling

restructuring, turnaround & insolvency

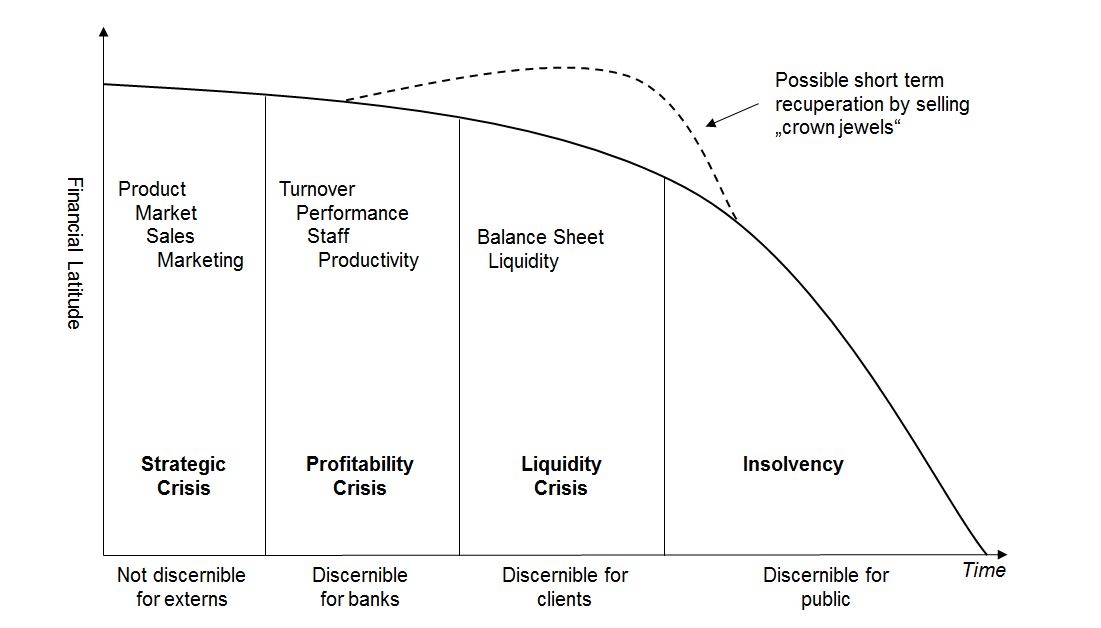

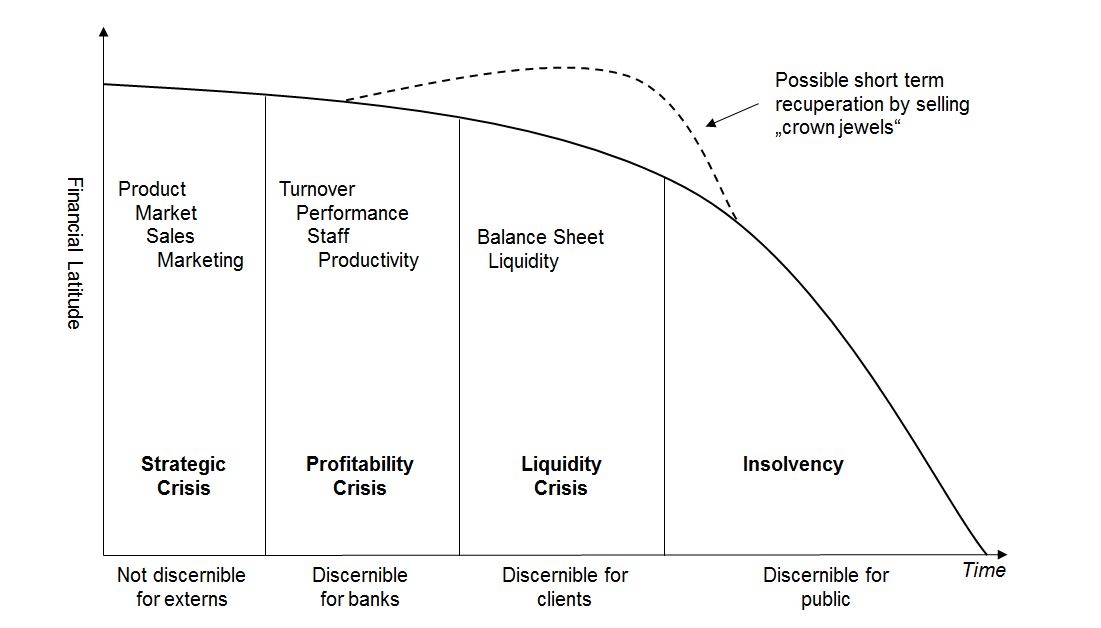

Corporate crises goes through various stages as shown in the diagramm below – and not every crisis is life-threatening. At each level the crisis may be averted with particular measures fitting the respective level. However, in order to overcome the crisis as a whole, it is necessary to resolve it on each level in reverse order. As the crisis proceeds from one level to another, the pressure increases while the actual possibilities to act diminish. This starting point differs greatly from other problematic situations that might occur in enterprises. Hence, an approach merely focusing on legal advice will therefore not suffice to solve the corporate crisis. Rather, an understanding of commercial needs, the ability to lead and personal assertiveness are required in order to master the crisis.

In the roughly twenty years I spent in this industry, I acted on every level of a crisis and took the position of every possible stakeholder in such a situation, e.g. the role of the “acting insolvency administrator” (“Schattenverwalter”), counsel to the enterprise or advisor to creditors. I have rescued businesses in or outside of insolvency.

Against this background, I regularly advise entrepreneurs and enterprises on the avoidance of insolvency, on liability risks or the commencement of an insolvency procedure. In addition to the “classic” means to restructure in insolvency, namely through the implementation of a so-called insolvency plan or through the transfer of assets to a new entity (“übertragende Sanierung”), I regularly advise on new innovative methods like trust-constructions or a debt-to-equity-swap. Also, I have a large experience of turnarounds in an international context. I advised on English schemes of arrangement as well as on Chapter 11 procedures under US-law, to name but a few.

Finally, I regularly advise foreign creditors on their entitlements in German insolvency proceedings, in particular regarding the commencement of such proceedings, the enforcement of claims or the avoidance of claims.

cases ▾

- Advising the managing director of a start-up in the bio-technology sector during the crisis of the business

- Advising the interim managing director before accepting and throughout his operations in a company in crisis

- Advising a Dutch corporation with regard to insolvency risk in the liquidation / sales process of its German subsidiary

- Advising the shareholder/managing directors of a Berlin-based “FinTech” start-up during the run-up to an insolvency procedure with debtor-in-possession status

- Advising a lawyer in assessing the insolvency-related consequences of a change in the jurisprudence about particular fees according to the German Copyright law

- Advising the shareholder/managing directors of an SME in the automotive-sector to prevent insolvency after the initiation of enforcment measures, negotiating a temporary moratorium with the bank, stabilising & restructuring company, negotiating final moratorium

- Advising the management of a group of companes in the charity sector with regard to insolvency risks of one of its subsidiaries

- Advising and representing the management of a German SME in the waste-disposal/energy sector, among others in the drafting of the expert opinion on the continuation prognosis (comparable to an independent business review (IBR)) and the negotiations with the banks and shareholders about the restructuring concept

- Serving as managing director of a small company in the charity sector (social entrepreneurship) thereby avoiding insolvency, drafting and implementing the turnaround plan, securing further financing, developing sales and marketing, business processes and controlling

- Serving as non-executive director (“Beirat”) of a Berlin based SME, responsible to monitor conception and implementation of working procedures, implementing reporting-structure, advising shareholder on corporate strategy, de-leveraging the company

- Advising an association of social businesses in the conception of a new compliance structure

- Advising and Representing the expert witness in the process of drafting the expert opinion on the continuation prognosis (comparable to an independent business review (IBR)) for an international group of companies in the packaging business

- Advising a German SME in the engineering sector on the avoidance of insolvency, commencement of distressed M&A proceedings and search for investors

- Advising and Representing the German insolvency administrator of a major German solar group of companies with a view to sell the US operations of the group, stabilizing the US operations, coordinating a sale in a Chapter 11 procedure (363 sale), achieving recognition of the German insolvency procedure in a Chapter 15

- Advising a German SME in the engineering sector on the appropriate steps to safeguard the enterprise after having lost a trial on product liability in the USA

- Advising the minority shareholder of a German company in the wind-energy sector on the prevention of a debt-to-equity swap against his will

- Advising and representing a real estate investment fund after the end of particular subsidies (Anschlussförderung), drafting the turnaround-concept and negotiation with the banks

- Advising two German major banks on the restructuring of a failed CMBS-transaction, in particular regarding their entitlements in the default of the debtor, counselling throughout the out-of-court restructuring

- Advising the management of a multinational group of companies in the restructuring of its debt stemming from a failed LBO including the successful completion of a Chapter 11 procedure also for the German companies in the group

- Advising a major German bank during the restructuring of a syndicated credit facility in England, where, among others, a scheme of arrangement was implemented

- Advising an upper public administrative body of a German state in the planning and creation of an insolvency department.

- Advising and representing the management of a company in the alternative energy-sector throughout the turnaround negotiations with the banks.

- Advising a German bank throughout the attempt to rescue a company in the charity sector

- Advising the shareholder of a large German fashion retail chain in the planning and implementation of its restructuring through an insolvency plan procedure including debtor-in-possession; then, advising the CRO in the successful realization of the planning

- Advising the shareholder through the insolvency of its SME telecoms company, thereby drafting and implementing an insolvency plan in co-operation with the insolvency administrator.

- Advising and representing shareholder and management in the successful recovery of a group of companies in the social sector following an extensive fraud scheme thereby implementing a complex out-of-court restructuring mechanism.

forensic services

Quite frequently in the context of a crisis, but not limited to such extraordinary circumstances, companies engage me to investigate in cases with a potential criminal background, to instruct and to coordinate with the law enforcement authorities and to pursue damages and recover lost assets. In the last years, the work in this area mostly concerned investigations into fraud and corruption in SME’s. In some of these cases I was able to resolve the financial crisis through the recovery of substantial assets.

cases ▾

- Leading internal investigations with regard to potential fraud after settlement with a former business partner, motion to engage special insolvency administrator, preparing criminal charges, preparing claims for civil damages

- Leading internal investigations after bribery case in a major German company, co-ordinating private and official investigations, filing complex criminal charges, advising and representing client in ensuing successful asset recovery

- Leading internal investigations after industrial espionage, co-ordination of private investigators and law enforcement authorities, filing criminal charges

- Representing and advising the US-trustee in insolvency in the investigation of a Ponzi scheme set-up by a US media tycoon, securing assets situated in Germany

- Leading the investigations after a fraud case in the charity sector, thereby coordinating with the law enforcement authorities, filing several criminal charges, asset tracing and recovery in Germany, France, Greece, Switzerland, litigating and enforcing civil entitlements

business resilience management

According to the motto “the best crisis is the one that never happens”, I try to pass on the lessons learned from the numerous corporate crises I have encountered in such a way that companies can proactively prepare themselves for a crisis, i.e. become more resilient. Many measures are conceivable, starting with a company-adequate early risk detection system and suitable measures to secure liquidity, through to the conception and implementation of internal processes for customer-screeing (“Know Your Customer”).

cases ▾

- Conceptual design, planning and implementation of a receivables management system for a medium-sized housing association

- Advising an association of the social economy on the conception of a supervisory structure in the context of compliance efforts

- Advising a state supreme authority on setting up a department for handling insolvency cases in the authority’s area of responsibility

general business law

commercial law

Commercial law is the basis of business law. Quite frequently I advise clients in this area of law: For example, the re-financing of companies always leads to issues related to corporate law, e.g. on how to execute a reduction of the companys capital. Furthermore, I have a large experience in incorporating companies and was also repeatedly involved in the resolution of shareholder disputes.

cases ▾

- Planning and Advising throughout the implementation of a group-wide cash-pooling-system for a group domiciled in the Netherlands

- Regular advice for a major global advertising agency regarding issues of general corporate law

- Advising the shareholders of a partnership in the restructuring of their statutes

- Advising the liquidation of an SME partnership

- Advising several foundings of corporations, regularly using shelf-companies, thereby developing computer-aided programs to facilitate the drafting of the various documents

- Advising a German SME pharmaceutical company in the negotiations with potential partners, drafting the distribution agreements

corporate finance

Securing corporate financing is one of the core issues for entrepreneurs and managers. Particularly in view of the decreasing importance of bank financing and the increasing importance of alternative financing with its sometimes very different legal bases, this area is also constantly gaining in importance from a legal point of view

cases ▾

- Advising an international group based in the Netherlands on cash pooling issues concerning the German companies.

- Advising (as advisor) on securing and expanding corporate financing for further investments, assisting in negotiations with banks, reviewing relevant agreements

- Advising two German banks on the restructuring of a failed CMBS transaction, in particular on the exercise of their rights after a default, assisting in the out-of-court restructuring of the liabilities

- Regular advice on the drafting of loan and collateral agreements in connection with financing projects (investments, restructuring & transformation)

mergers & acquisitions

On a regular basis I advise investors and shareholders, e.g. insolvency administrators, in the transfer of enterprises in crisis and insolvency. Especially the acquisiton of distressed companies might prove to be highly lucrative. However, the purchase of a company in crisis or insolvency is one of the most complicated possible – not only from the legal point of view. There are, for example, certain habits and customs to be observed when dealing with an insolvency administrator. With this background I am also regularly engaged to represent parties in M&A transactions outside of a crisis.

cases ▾

- Advising the heiress of an association of architects during the management buy-in

- Advising a German family-owned business in the acquisition-process of an engineering business out of insolvency

- Advising a company in the Berlin social sector in the acquisition of a corresponding business out of insolvency

- Advising a major bank on the purchase of a major stake of corporate debt regarding a German automotive company

- Advising the Russian investor in the acquisition of a major stake in a German public listed company

- Regularly advising a major global advertising agency in the acquisition of several companies and the foundation of several joint ventures, at last a joint venture to market sport events

- Advising and representing a German bank in the acquisition of a major stake in a private-equity-group, thereby leading the due-diligence team, leading the negotiations, drafting the necessary documentation, post-merger-integration

enforcement & dispute resolution

Quite often, the successful assertion of legal entitlements is essential for the company’s business success – equally often, though, the success in court does not seem to be foreseeable.Therefore, I prefer to negotiate a settlement instead of formal legal proceedings. However, if I cannot prevent litigation, I have the experience to assert legal entitlements before German courts and to enforce these titles. Based on my longstanding work for large insolvency administrator firms, I have an extensive knowledge and expericence regarding avoidance and liability claims.

cases ▾

- Representation of shareholders in GmbH & Co. KG in the separation from the co-partner in the context of various court and criminal proceedings

- Preparation of a private expert opinion for an investor in a start-up company on the question of whether the company had become insolvent in the meantime, consequences for management

- Preparation of a private expert opinion on the damage eligible for compensation after the break-in of a warehouse

- Advising a Swedish law firm in avodiance claims of a German insolvency administrator

- Advising and defending an Austrian entrepreneur in German avoidance proceedings against a German insolvency administrator

- Advising a German law firm against avodiance claims of a German insolvency administrator

- Advising and representing a Berlin-based SME enterprise in various litigations after successfully restructuring in insolvency

- Advising and representing a Brazilian company after the insolvency of its German supplier in connection with claims for damages.

- Representing state-owned entities in connection with various avoidance claims

- Representing the German insolvency administrator in foreign mass-avoidance proceedings after criminal bankruptcy in Germany.